Is Mortgage Protection Insurance Worth it?

Sarah Woodbeck • January 9, 2022

We break down everything you need to know about Mortgage Protection

If you recently purchased a home or refinanced your mortgage, you may have received letters in the mail about mortgage life insurance. Different from a homeowner’s insurance policy that would protect the items inside your home, mortgage life insurance (also known as mortgage protection insurance) would protect the people living there. Wondering if mortgage life insurance is worth it? The short answer is yes, mortgage life insurance is worth it if you have anyone who depends on you financially.

Mortgage life insurance is a term life insurance policy that’s customized for homeowners. It’s an affordable way to protect your family from losing their home while providing the financial protection of a life insurance policy.

How mortgage life insurance works is a term life insurance policy that generally lasts the same term as your mortgage. This insurance would cover the remainder of your mortgage payments if you pass away while the policy is in force. This can provide financial relief to your spouse, partner, children, or other loved ones who may depend on you financially. They could stay in the home without having to worry about paying the mortgage.

Advantages of mortgage life insurance

Mortgage life insurance is one of the most affordable types of life insurance available with rates as low as $20/month. Most people don’t need to take a medical exam to qualify for coverage, making the process of getting life insurance simple and easy. Even better, your Bennett Financial agent can shop from more than 30 of the top-rated insurance carriers to get you the best price on the market today.

Disadvantages of mortgage life insurance

One disadvantage of mortgage life insurance is that it only offers protection for a set number of years (similar to the length of your mortgage). This means that if you need life insurance coverage later in life, you might need to take out another policy. While this type of policy used to be tied to your mortgage amount and paid to the lender, many new policies now offer flexible benefits where you can get even more out of your coverage.

Adding riders to your mortgage life insurance policy

There are several add-on benefits, known as riders, that can be added to your mortgage life insurance policy. If you were to be diagnosed with a critical illness or experience a disability that prevented you from making your mortgage payments, these riders would help you by providing payouts. You also have the option to add a return of premium rider, which would refund your premiums if you do not end up using your mortgage life insurance policy by the end of the term. To learn about additional benefits offered with mortgage life insurance, be sure to request more information from your Bennett Financial agent.

How to get mortgage life insurance

In most cases, you won’t need to undergo a medical exam to get mortgage life insurance. When you request a quote, your Bennett Financial agent will shop around to find you the most affordable rates on the market today. Your agent will present your options and help you get a policy in place that meets all your needs. With video conferencing available, you can get a policy in place from the comfort of home!

The bottom line

Mortgage life insurance not only offers financial protection and peace of mind, but it also protects your loved ones from unnecessary financial burdens. No one knows what the future holds, and there’s no reason to delay getting this important coverage.

If you would like to learn more and get a plan in place, get a quote today today to protect your home and loved ones. Your Bennett Financial agent is available for online policy consultations to help you get a plan in place in just a few simple steps.

Discover the diverse career paths available in the financial industry with our comprehensive guide. From investment banking to asset management and private equity, we break down the roles, required skills, salary ranges, and top companies in each field. Whether you're a beginner looking to start your journey or a professional considering a switch, this guide will provide valuable insights to help you navigate your future in finance. Learn about key valuation methods and what it takes to succeed in this dynamic industry. Perfect for aspiring financial professionals and those curious about finance.

Financial career paths, investment banking, asset management, private equity, hedge funds, corporate finance, financial planning, financial industry guide, career in finance, finance job roles.

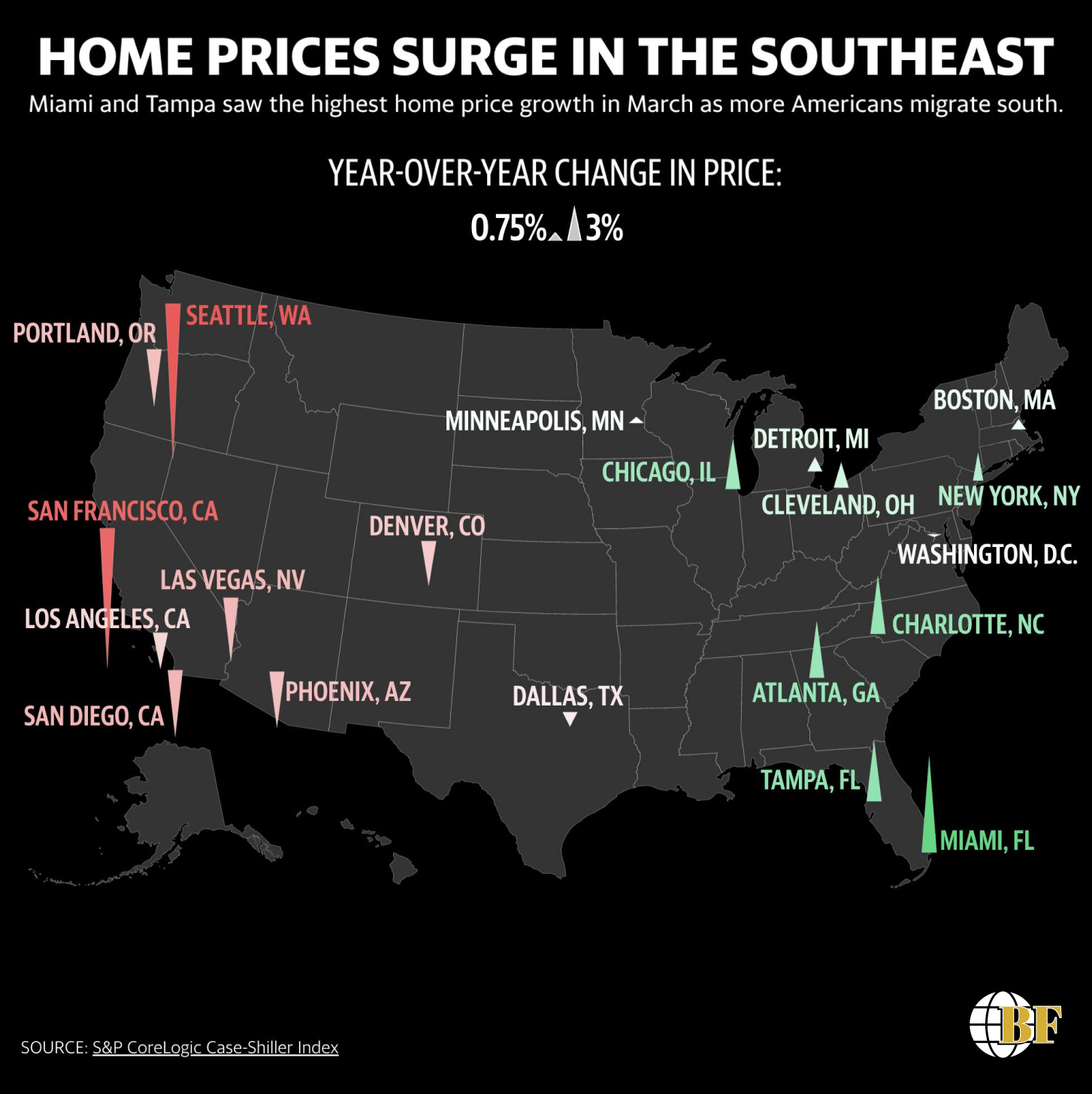

In today's ever-evolving financial landscape, real estate investment has emerged as a powerful wealth-building strategy. Bennett Financial, a forward-thinking leader in the financial industry, recognizes the potential for individuals to achieve substantial returns by strategically navigating thriving real estate markets. As the South East experiences a surge in home prices, particularly in Miami and Tampa, now is the time to explore the exciting opportunities that lie within this sector.