What is Infinite Banking and How does it work?

Gram Henderson • January 16, 2023

Have you wondered how the rich use life insurance?

Have you recently heard of 'Infinite Banking' and wondered what it means?

Well, to make it simple this is done through life insurance policies. More specifically cash-value policies. This is done by taking out a cash value life insurance policy, and then using the cash value of the policy

to fund other investments or expenses.

Now you're probably wondering what Cash Value is.

Cash value refers to a component of a permanent life insurance policy, such as whole life or universal life insurance, that is set aside and invested. This cash value grows over time and can be accessed by the policyholder through policy loans or withdrawals.

The cash value component is created by the portion of the premium that is not used to pay for the cost of insurance. This money is invested by the insurance company, and the returns on these investments accrue to the cash value of the policy. The cash value can be used to pay the premiums, to borrow against, to withdraw or to pay out at the end of the policy term, according to the policyholder's needs.

- One of the main benefits of cash value is that it grows tax-free, which means that the policyholder can access this money without having to pay taxes on it. This can be a great way to save for retirement or other long-term financial goals.

- Another benefit of cash value is that it can be used as a self-funding source of wealth. The policyholder can use the cash value to fund other investments or expenses, such as starting a business, paying for a child's education, or purchasing a second home.

In summary, cash value is a component of permanent life insurance policies that grows over time and can be accessed by the policyholder for various purposes.

How does it grow and how long does it take?

As we mentioned above; cash value accrues through the insurance companies investments of your premiums. When a policyholder pays their premium, the insurance company takes a portion of the premium and uses it to pay for the cost of insurance, which is the cost of providing coverage in the event of the policyholder's death. The remaining portion of the premium is set aside and invested by the insurance company to create the cash value of the policy.

Now the average interest rate for cash value on a universal life insurance policy can range from 2-7% depending on the insurer. Meaning the interest accrued beats most banks and CD's, While also providing you life insurance and additional benefits.

In your policy you will usually see two sections in a cash value chart. One being an Assumed Rate(4-7%), this is the rate at which the company believes they can provide on your premiums. The second being, Guaranteed Rate(2-3%), This is the rate that worst comes to worst you'll receive on your investment. This insures that you're not going into an investment at 100% risk. These rates are just averages and vary on many different factors, but overall cash value accumulation is generally a safe investment.

Funding your Investment

Depending on the insurer, most companies will allow a 'Dump' of funds into the policy allowing it to compound that amount and grow faster. A typical policy holder will put anywhere from $1000-$10,000 as a starting point.

As time goes on the initial 'Dump' of funds is what the 2-7% interest rate is being exercised on as well as your premiums. If you don't have boatloads of extra capitol laying around another practice is to 'Over Fund' your policy.

Overfunding a life insurance policy refers to paying more into the policy than is necessary to keep it in force. This can occur when the policyholder pays more than the required premium, or when they make a lump sum payment or series of payments that exceeds the policy's cash value.

There are several potential benefits to overfunding a life insurance policy, including:

- Increase the cash value of the policy,

- Tax benefits: Overfunding a policy can provide tax benefits, such as tax-deferred growth of cash value and the ability to borrow against the cash value tax-free.

- Premium savings: Overfunding a policy can help pay future premiums, reducing the amount of money the policyholder will need to pay out of pocket.

- Protection for beneficiaries: Overfunding a policy can increase the death benefit and provide additional financial protection for the policyholder's beneficiaries.

How do the rich use it to build wealth?

There are several ways that wealthy individuals use the cash value of their life insurance policy to grow their wealth. Here are a few examples:

- Using the cash value to fund other investments: Some wealthy individuals will use the cash value of their life insurance policy to fund other investments, such as stocks, real estate, or private equity. They can borrow against the cash value of the policy to make these investments and use the returns to pay off the loan and grow their wealth.

- Using the cash value to start a business: Another way that wealthy individuals can use the cash value of their life insurance policy is to start a business. They can borrow against the cash value to fund their business venture and use the income generated by the business to pay off the loan and grow their wealth.

- Using the cash value to purchase real estate: Some wealthy individuals use the cash value of their life insurance policy to purchase real estate. They can borrow against the cash value to purchase a property and use the rental income or appreciation of the property to pay off the loan and grow their wealth.

- Using the cash value to purchase private equity or other alternative investments: Wealthy individuals can also use the cash value of their life insurance policy to invest in private equity or other alternative investments, such as hedge funds or venture capital funds. These types of investments can generate high returns, which can be used to pay off the loan and grow their wealth.

It's important to note that these are examples and it's always recommended to consult with a financial professional

before making any investment decisions.

Summary

In summary, life insurance can provide financial security for your loved ones in the event of your death, provide a source of income for your family, and can be used as a savings and investment tool. It's a responsible way to protect the people you care about most and ensure their financial well-being. At Bennett Financial,

we are experts in life insurance and how to use it as an asset. We can help you understand the different types of policies available, and how to use the cash value to create a self-funding source of wealth. Contact us

today to learn more about how life insurance can be used as an infinite banking system and how it can benefit you and your family.

Discover the diverse career paths available in the financial industry with our comprehensive guide. From investment banking to asset management and private equity, we break down the roles, required skills, salary ranges, and top companies in each field. Whether you're a beginner looking to start your journey or a professional considering a switch, this guide will provide valuable insights to help you navigate your future in finance. Learn about key valuation methods and what it takes to succeed in this dynamic industry. Perfect for aspiring financial professionals and those curious about finance.

Financial career paths, investment banking, asset management, private equity, hedge funds, corporate finance, financial planning, financial industry guide, career in finance, finance job roles.

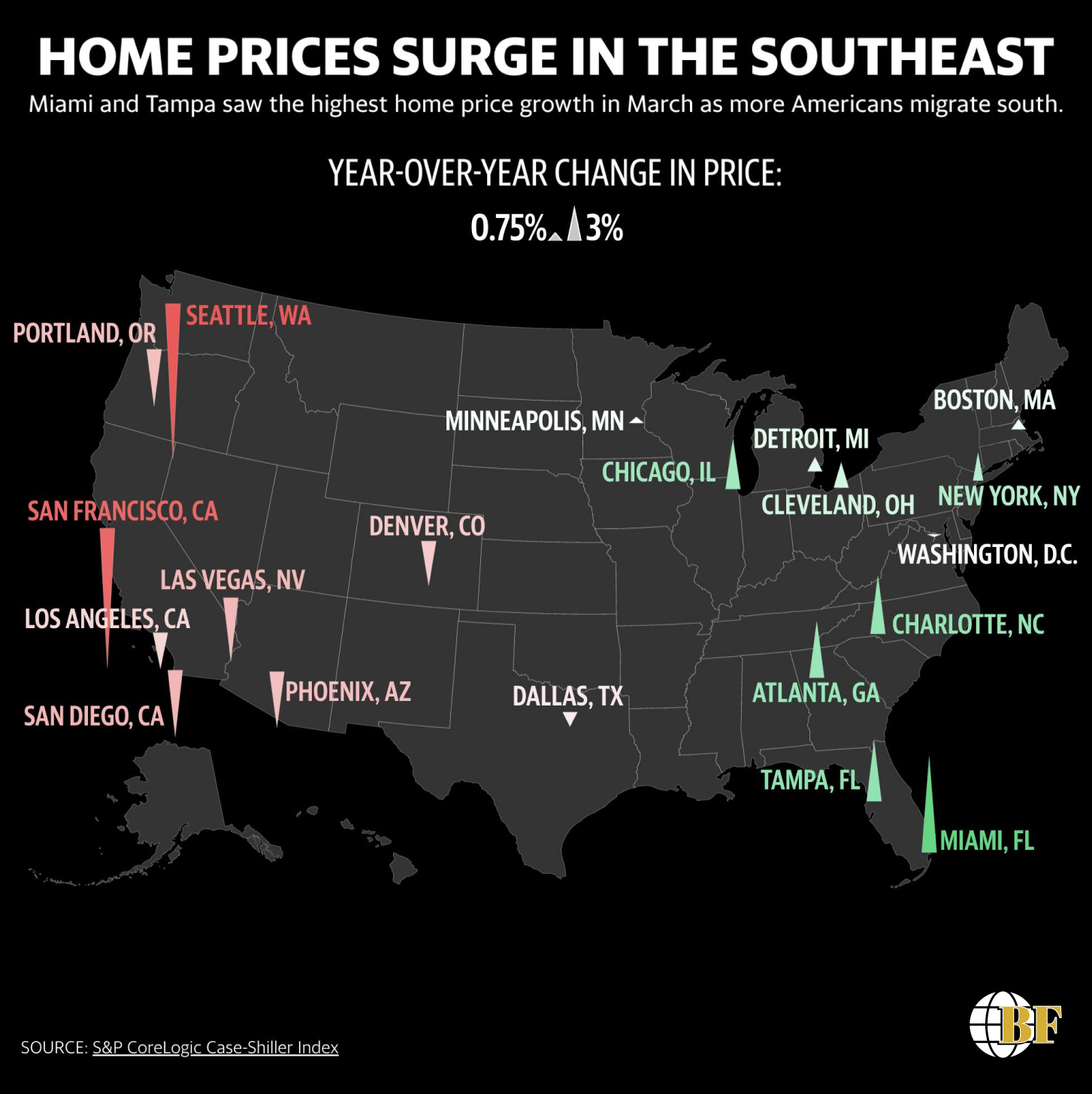

In today's ever-evolving financial landscape, real estate investment has emerged as a powerful wealth-building strategy. Bennett Financial, a forward-thinking leader in the financial industry, recognizes the potential for individuals to achieve substantial returns by strategically navigating thriving real estate markets. As the South East experiences a surge in home prices, particularly in Miami and Tampa, now is the time to explore the exciting opportunities that lie within this sector.

Mortgage protection insurance is a type of life insurance designed to pay off a borrower's mortgage in the event of their death, disability, or job loss. The main benefit of mortgage protection insurance is that it provides financial security for a borrower's family in the event of their death or incapacity, by ensuring that their mortgage is paid off and their home remains in their family. Additionally, some policies may offer additional benefits such as cover for disability, unemployment and critical illness. This means that the policyholder and their family will not have to worry about losing their home and will have peace of mind knowing that their mortgage will be taken care of. It's a great way to ensure that your loved ones will not be left with a mortgage payment they cannot afford.