"Escape the Bank Crisis: Discover the Safe and Profitable Investment Alternative That Banks Don't Want You to Know About"

Kelsey D • Apr 03, 2023

If the bank crisis has you worried about your money, Then look into Secure and Profitable Investment Option that Outperforms Traditional Savings.

As the local community continues to worry about the ongoing bank crisis, many are wondering what their options are to protect their hard-earned money. While traditional savings accounts and mutual funds may seem like safe choices, there is a smarter and historically safer alternative that can bring peace of mind during uncertain times: annuities.

An annuity is a financial product that provides a guaranteed stream of income for a specific period or for life, in exchange for a lump sum payment or regular contributions. Annuities are offered by insurance companies and are often used as a retirement income vehicle. But they can also be used as a safe haven for cash during economic uncertainty.

Compared to traditional savings accounts and mutual funds, annuities have several advantages. One of the most significant benefits is the guarantee of principal and interest. Unlike savings accounts, which are insured by the FDIC up to $250,000, annuities are backed by the financial strength of the insurance company. This means that even in the event of a market downturn or economic crisis, the annuity owner is guaranteed to receive their principal and interest payments.

Annuities also offer tax-deferred growth, which means that the earnings on the annuity are not taxed until they are withdrawn. This can be a significant advantage for those in higher tax brackets or those looking to defer taxes until retirement.

In addition to the above benefits, annuities can also provide a steady stream of income for life. With traditional savings accounts and mutual funds, there is no guarantee of how long the money will last. But with an annuity, the owner can choose to receive payments for a specific period or for life, providing a reliable source of income during retirement.

At Bennett Financial, we understand the concerns that our local community has during times of economic uncertainty. That's why we offer a range of annuity options to meet our clients' needs. We work with top-rated insurance companies to ensure that our clients' money is safe and secure.

Our team of financial advisors is dedicated to helping our clients make informed decisions about their finances. We take the time to understand each client's unique situation and develop a personalized plan that aligns with their goals and priorities.

In conclusion, while the ongoing bank crisis may be causing anxiety and worry, there are smarter and safer alternatives available. Annuities offer a range of benefits over traditional savings accounts and mutual funds, including guaranteed principal and interest, tax-deferred growth, and a steady stream of income for life. At Bennett Financial, we are here to guide our clients through these uncertain times and provide them with peace of mind.

A better way to bank

Share

Tweet

Share

Mail

By Anthony H

•

21 Jun, 2023

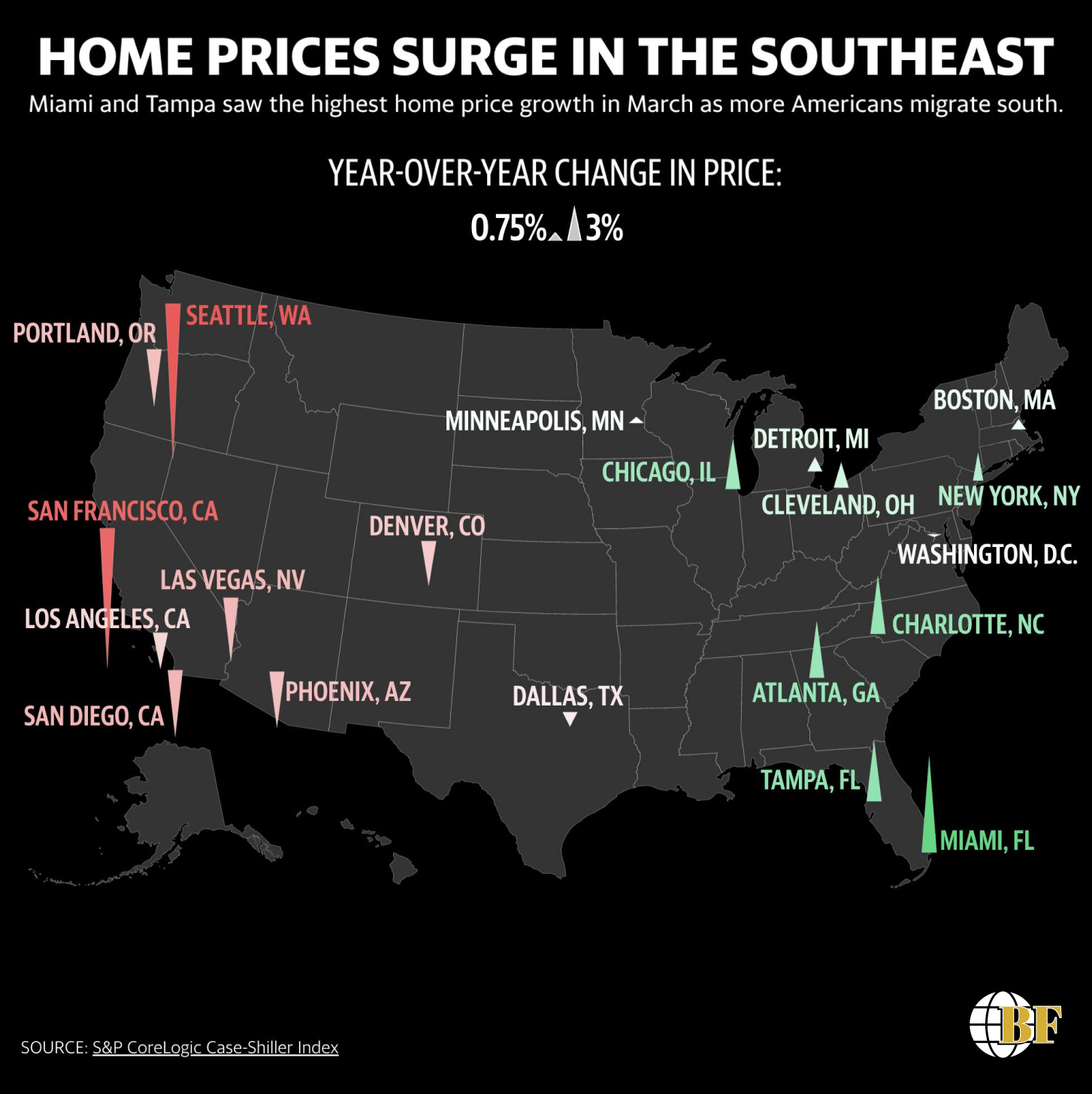

In today's ever-evolving financial landscape, real estate investment has emerged as a powerful wealth-building strategy. Bennett Financial, a forward-thinking leader in the financial industry, recognizes the potential for individuals to achieve substantial returns by strategically navigating thriving real estate markets. As the South East experiences a surge in home prices, particularly in Miami and Tampa, now is the time to explore the exciting opportunities that lie within this sector.

By Gram Henderson

•

16 Jan, 2023

Life insurance can be used as an infinite banking system, which is a way to use cash value life insurance to create a self-funding source of wealth. This is done by taking out a cash value life insurance policy, and then using the cash value of the policy to fund other investments or expenses.

By Sarah Woodbeck

•

09 Jan, 2022

Mortgage protection insurance is a type of life insurance designed to pay off a borrower's mortgage in the event of their death, disability, or job loss. The main benefit of mortgage protection insurance is that it provides financial security for a borrower's family in the event of their death or incapacity, by ensuring that their mortgage is paid off and their home remains in their family. Additionally, some policies may offer additional benefits such as cover for disability, unemployment and critical illness. This means that the policyholder and their family will not have to worry about losing their home and will have peace of mind knowing that their mortgage will be taken care of. It's a great way to ensure that your loved ones will not be left with a mortgage payment they cannot afford.

By Nathan Earwood

•

09 Jan, 2022

Life insurance can provide financial security for your loved ones in the event of your death, provide a source of income for your family, and can be used as a savings and investment tool. It's a responsible way to protect the people you care about most and ensure their financial well-being.

About Us

We are dedicated to empowering individuals and businesses to achieve their financial goals through expert guidance, tailored strategies, and trusted partnerships. Elevate your financial journey with us.

Contact info

Headquarters: Chattanooga, TN 37405

(423) 598-6657

Help@BennettFinancial.org