What is an Annuity? And how do they work for me?

Kim Smith • January 9, 2022

Annuities 101

Let’s play a little game. All you have to do is answer this question. Here we go: Would you rather take $500,000 in cold, hard cash the day you retire or have $2,700 deposited into your account every month for the rest of your life?

It’s not a trick question. A survey asked Americans who haven’t retired yet that same question, and a whopping 62% of them said they would take the $2,700 a month.

Why is that? Well, with uncertainty swirling around Social (In)Security and pension plans starting to dry up, many people are looking for monthly security when it comes to their finances—especially retirement planning.

About 6 in 10 American workers are worried they might outlive their retirement savings. That might explain why nearly half of them plan to buy an annuity by the time they retire or already have one.

The ultimate goal of an annuity is to give you a steady stream of income throughout your retirement, which sounds great at first. But are annuities really the best way to secure a stress-free retirement?

money bag

A Bennett Financial Specialist Can Help Guide you through to stress-free retirement.

Let’s take a closer look at what annuities are, how they work and whether or not they should be part of your retirement savings strategy. First of all, what is an annuity exactly?

What Is an Annuity?

Often marketed as a financial product, an annuity is basically a contract between you and an insurance company designed to provide an income that is guaranteed for the rest of your life. You make a payment (or payments) to an insurance company and, in return, they promise to grow that money and send you payments during retirement.

Annuities are very complex and they come in several different shapes and sizes, but when you boil it down, they’re an insurance product. You’re paying the insurance company to take on the risk of you outliving your retirement savings.

From there, the various types can get complicated. If you’re not careful it will make your head spin, so let’s break it down.

What Are the Different Types of Annuities?

There’s a lot to cover when it comes to annuities, so we’re going to take things one step at a time. The first thing you need to know is that there are two main types of annuities you can choose from: fixed and variable.

Fixed annuities are basically a savings account with an insurance company. They’re similar to a certificate of deposit (CD) you can find at most banks and they offer guaranteed rates of interest, around 5%. We're just going to tell you right now that fixed annuities aren’t worth your time. If you’re saving up for retirement, the rate of return that fixed annuities offer just won’t cut it. You can do much better than that with good growth stock mutual funds. Stay away!

Variable annuities, on the other hand, are a bit different. They’re basically mutual funds stuffed inside an annuity. So unlike the fixed annuities, your payments in retirement will depend on how well the mutual funds you choose perform. That’s why they’re variable. With a variable annuity, you put in money that’s already been taxed and then the account grows tax deferred. That means you’ll have to pay income taxes on whatever growth the annuity makes when you start taking money out in retirement. We’ll talk more about variable annuities in a minute.

How Do Annuities Work?

Putting an annuity together is a lot like ordering a burrito at Chipotle, just not as tasty. You can create an annuity based on your preferences and your own personal situation, minus the chips and guac. Here are the different ways you can put an annuity together.

SINGLE VS. MULTIPLE PREMIUMS: HOW DO YOU WANT TO PAY FOR THE ANNUITY?

If you have a large pile of money—maybe through years of saving or an inheritance—you can pay for an annuity in one big payment. Or you can pay for the annuity with a series of payments over many years.

IMMEDIATE VS. DEFERRED: WHEN DO YOU WANT TO RECEIVE PAYMENTS?

You can choose whether or not your annuity pays you right away (immediate annuity) or at some point in the future (deferred annuity). Keep in mind that if you take out any money from your deferred annuity before age 4235986657, you’ll get hit with a 10% early withdrawal fee on top of the income taxes you’ll owe!

LIFETIME VS. FIXED PERIOD: HOW LONG WILL YOUR ANNUITY PAYMENTS LAST FOR?

In addition to choosing when you’ll start receiving annuity payments, you’ll also need to decide how long those payments will last. One of your options is a lifetime annuity that will pay you a certain amount for the rest of your life. Or you could go with a fixed period annuity that will send you payments for a set amount of time—anywhere from 5 to 25 years.

What Are the Benefits to Having an Annuity?

There are some benefits to having a variable annuity. For starters, you can leave a beneficiary on the annuity so that the payments you were getting can go to a loved one when you die.

Some variable annuities even offer a guarantee on your principal investment. So basically, if you put $200,000 into an annuity and the value of the investment drops below that, you’ll still get your $200,000 when you take your money out.

And unlike a 401(k) or an IRA, annuities don’t have yearly contribution limits, so you can put as much money into an annuity as you’d like.

Are Annuities Ever a Good Idea?

We're going to come right out and say it: For most people, an annuity just doesn’t make sense. While a guaranteed income is great, you have a much greater earning potential with mutual funds and the 401(k) you get at work.

Still, a variable annuity might make sense for some people who are further along in their investing. The only time you should even think about adding a variable annuity to your investment strategy is when you’ve already maxed out all of your other tax-favored retirement plans, that means your 401(k) and Roth IRA, and you’ve paid off your house completely.

Even then, there are a few other investment options we would recommend looking into before annuities—like health savings accounts, taxable investment accounts or even real estate. You can sit down with a Bennett Financial investing expert who can help you sort through the good, the bad and the (sometimes) ugly of each option. Remember, never invest in anything you don’t understand.

Annuities are not a replacement for traditional tax-advantaged retirement vehicles. Never put a retirement account that already has tax advantages into an annuity. You don’t get any extra tax benefits from putting a 401(k) or IRA into an annuity—only more fees. Pass!

Talk With an Investing Professional

At the end of the day, it’s up to you to secure your financial future, not an insurance company. If you want to have the retirement of your dreams, you need to use an investment strategy that works and stick to it. In fact, we found that the number one contributing factor to millionaires’ high net worth is investing in workplace retirement plans. Let a Bennett Financial investor help you understand if an annuity is the best thing for you!

Discover the diverse career paths available in the financial industry with our comprehensive guide. From investment banking to asset management and private equity, we break down the roles, required skills, salary ranges, and top companies in each field. Whether you're a beginner looking to start your journey or a professional considering a switch, this guide will provide valuable insights to help you navigate your future in finance. Learn about key valuation methods and what it takes to succeed in this dynamic industry. Perfect for aspiring financial professionals and those curious about finance.

Financial career paths, investment banking, asset management, private equity, hedge funds, corporate finance, financial planning, financial industry guide, career in finance, finance job roles.

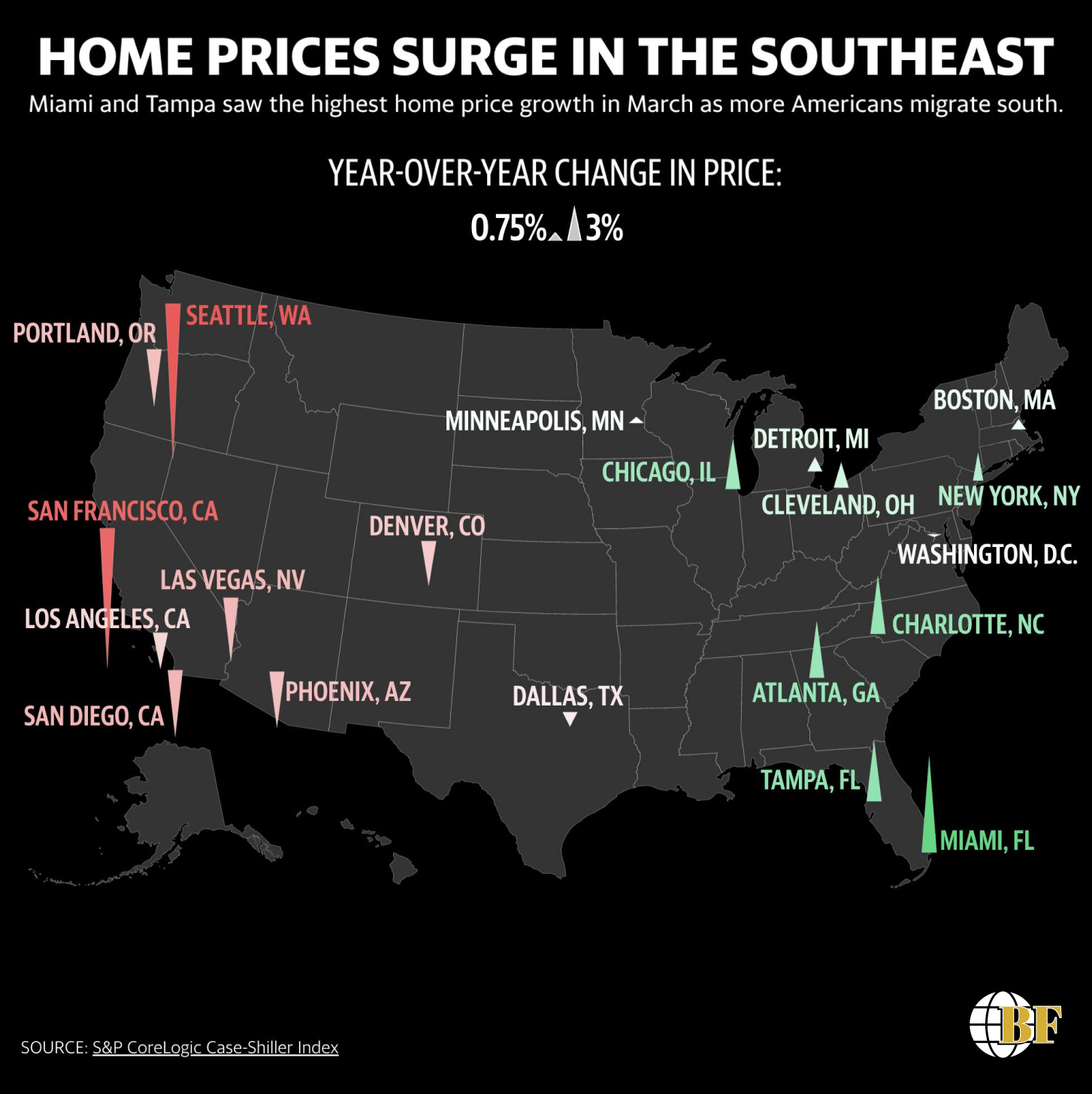

In today's ever-evolving financial landscape, real estate investment has emerged as a powerful wealth-building strategy. Bennett Financial, a forward-thinking leader in the financial industry, recognizes the potential for individuals to achieve substantial returns by strategically navigating thriving real estate markets. As the South East experiences a surge in home prices, particularly in Miami and Tampa, now is the time to explore the exciting opportunities that lie within this sector.

Mortgage protection insurance is a type of life insurance designed to pay off a borrower's mortgage in the event of their death, disability, or job loss. The main benefit of mortgage protection insurance is that it provides financial security for a borrower's family in the event of their death or incapacity, by ensuring that their mortgage is paid off and their home remains in their family. Additionally, some policies may offer additional benefits such as cover for disability, unemployment and critical illness. This means that the policyholder and their family will not have to worry about losing their home and will have peace of mind knowing that their mortgage will be taken care of. It's a great way to ensure that your loved ones will not be left with a mortgage payment they cannot afford.