"Seizing the Opportunity: Bennett Financial Explores Thriving Real Estate Markets.

Anthony H • Jun 21, 2023

In today's ever-evolving financial landscape, real estate investment has emerged as a powerful wealth-building strategy. Is now the time to invest?

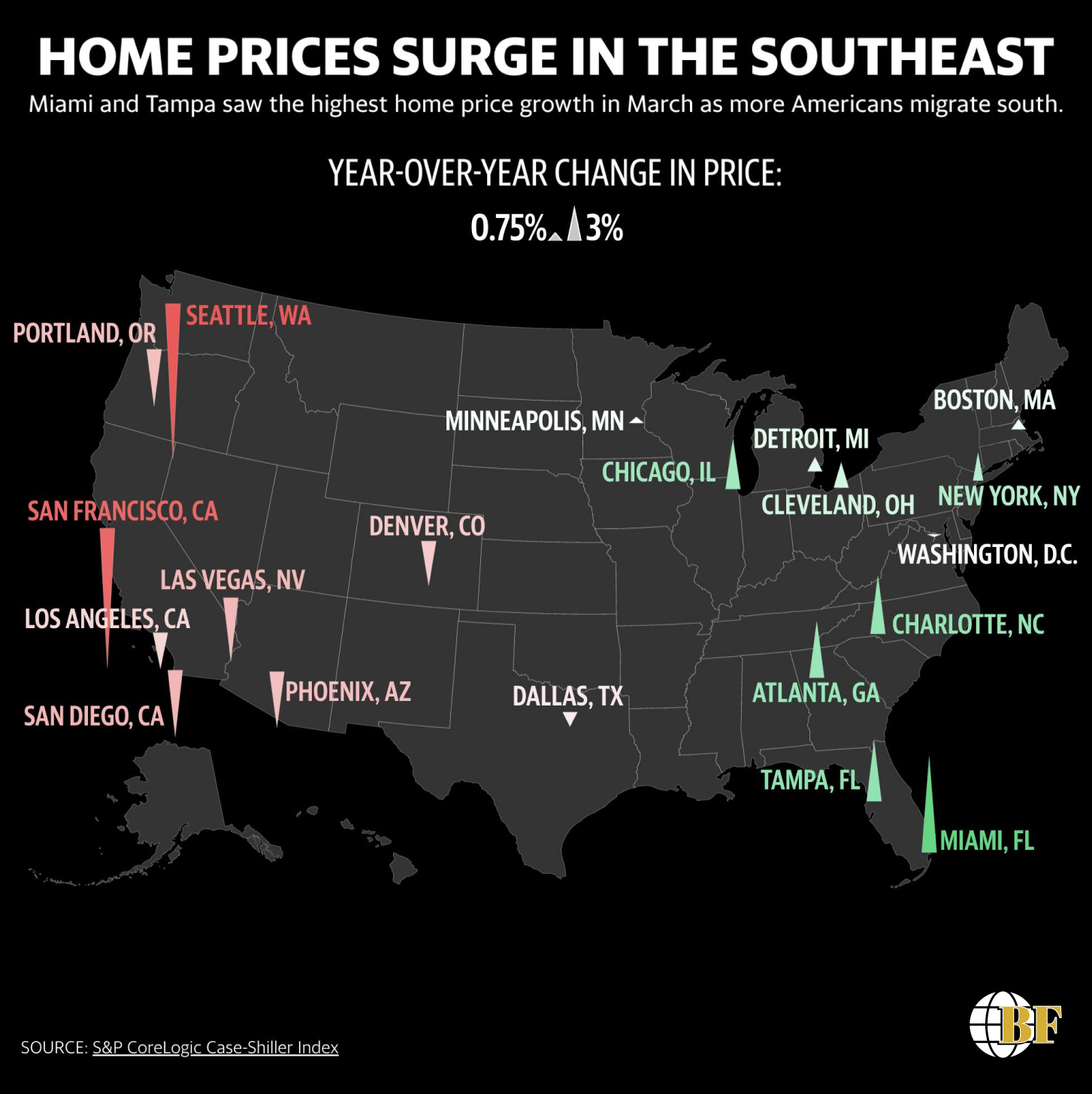

Bennett Financial, a forward-thinking leader in the financial industry, recognizes the potential for individuals to achieve substantial returns by strategically navigating thriving real estate markets. As the South East experiences a surge in home prices, particularly in Miami and Tampa, now is the time to explore the exciting opportunities that lie within this sector.

The Power of Real Estate:

Real estate has long been regarded as a tangible asset class with the potential for both steady cash flow and long-term appreciation. Bennett Financial understands the immense wealth-building potential that lies within this industry. By leveraging their expertise and extensive network, they empower individuals to make informed investment decisions and navigate the intricacies of the real estate market.

Miami and Tampa: Hubs of Growth:

Recent data reveals that Miami and Tampa have emerged as epicenters of real estate growth, with home prices skyrocketing. The combination of increased migration and robust economic development has fueled this upward trend. As Americans flock to the South East seeking new opportunities and a higher quality of life, Miami and Tampa offer unparalleled potential for investors to reap significant rewards.

A Nationwide Perspective:

Zooming out to a national scale, it becom es evident that the surge in home prices is not limited to specific cities. The map of the United States showcases the remarkable changes in prices since March, highlighting the vast array of cities experiencing notable growth. This nationwide perspective presents a unique opportunity for individuals, regardless of their location, to take advantage of the current real estate market dynamics.

Join Bennett Financial's Winning Team:

Bennett Financial, a trusted name in the financial industry, invites ambitious individuals to join their winning team. Aspiring investors who seek guidance and support in navigating the world of real estate can benefit from Bennett Financial's comprehensive approach. By aligning with the company's sophisticated strategies and personalized advice, individuals can tap into the lucrative potential of real estate investing.

Conclusion:

In the face of surging home prices in the South East and across the nation, Bennett Financial stands as a reliable partner on the path to financial success. With their proven track record and dedication to empowering investors, Bennett Financial provides the tools, expertise, and support needed to seize the opportunities presented by the thriving real estate markets. Don't miss your chance to turn the current market dynamics into a gateway for wealth creation. Reach out to Bennett Financial today and embark on a journey towards financial prosperity.

Share

Tweet

Share

Mail

By Gram Henderson

•

16 Jan, 2023

Life insurance can be used as an infinite banking system, which is a way to use cash value life insurance to create a self-funding source of wealth. This is done by taking out a cash value life insurance policy, and then using the cash value of the policy to fund other investments or expenses.

By Sarah Woodbeck

•

09 Jan, 2022

Mortgage protection insurance is a type of life insurance designed to pay off a borrower's mortgage in the event of their death, disability, or job loss. The main benefit of mortgage protection insurance is that it provides financial security for a borrower's family in the event of their death or incapacity, by ensuring that their mortgage is paid off and their home remains in their family. Additionally, some policies may offer additional benefits such as cover for disability, unemployment and critical illness. This means that the policyholder and their family will not have to worry about losing their home and will have peace of mind knowing that their mortgage will be taken care of. It's a great way to ensure that your loved ones will not be left with a mortgage payment they cannot afford.

By Nathan Earwood

•

09 Jan, 2022

Life insurance can provide financial security for your loved ones in the event of your death, provide a source of income for your family, and can be used as a savings and investment tool. It's a responsible way to protect the people you care about most and ensure their financial well-being.

About Us

We are dedicated to empowering individuals and businesses to achieve their financial goals through expert guidance, tailored strategies, and trusted partnerships. Elevate your financial journey with us.

Contact info

Headquarters: Chattanooga, TN 37405

(423) 598-6657

Help@BennettFinancial.org