Is Life Insurance Right For You?

Nathan Earwood • Jan 09, 2022

Life Insurance and everything you need to know

This question is asked more times then you would think. Insurance, especially Life Insurance is always a good idea. Not only does life insurance protect you and your family, but it also offers some peace of mind. Here we list 7 important reasons we believe life insurance can benefit you.

A good financial plan is like a jigsaw puzzle with different pieces addressing specific needs. Saving, paying off debts, growing your wealth, protection — all working together to maintain your financial health. You might be hard at work on the first three things on that list. But have you given thought to the protection part, which includes buying life insurance?

It's a financial safety net for you and your loved ones.

-You love your spouse, your kids, your parents. The last thing you want is for them to be left in a lurch financially if something were to happen to you.

The primary reason for purchasing life insurance is to help your loved ones shoulder the financial burden of your death. The proceeds from your policy can go towards burial expenses and everyday bills or bigger things like a mortgage or your kids’ education when the time comes.

You Don't want to leave debt behind.

-Ideally, you’re working hard to pay down your debt, but life doesn’t always follow our plans. If you were to die suddenly, you wouldn’t want your family to be left with the burden of credit cards, car loans, student loans or a mortgage. If you purchase enough coverage, a life insurance policy could help clear the deck so those bills aren’t hanging over your partner or loved one’s heads.

This is an especially important consideration if your parents cosigned on your private student loans or other liabilities. Being left with those debts could put a strain on their finances at a point in life when they might be readying for retirement.

You Own A Business.

-Speaking from experience, being your own boss is great. I work solo but you might have a business partner or run the business with your family’s help. Life insurance can help protect the investment of time and money you’ve made in the business.

Even if you’re a freelancer like me, you could still benefit from having life insurance. Your loved ones could use the proceeds of your policy to help pay outstanding loans or credit card debt owed by the business.

It's Your Legacy

-If you’re in your 20s, 30s, or 40s, you might not be thinking about the legacy you want to leave behind. But, it’s never too soon to consider it. Ask yourself what you want to leave behind for your kids. Maybe you want to leave something to charity as well. A life insurance policy can help fulfill those future wishes you have.

Life insurance can also be a tax-efficient way to pass on assets to your loved ones. Generally, payouts for term life insurance policies aren’t subject to federal income tax, which makes it useful in estate planning. And, your beneficiary won’t have to wait for your life insurance to go through probate with the rest of your estate.

It’s affordable

-The most common roadblock to getting life insurance can be the assumed cost of premiums. Getting covered, however, can be pretty affordable.

Here are a few examples of monthly premiums for a term life insurance policy. The cost of coverage varies based on factors like age, gender, health, term length and coverage amount. These premiums are for non-smokers in excellent health.

You’ll get the best rates the younger and healthier you are but don’t let age or health put you off. Even if you’re in your 30s, 40s or even 50s already, life insurance can still be a sound — and budget-friendly — purchase.

Buying life insurance is easy

I put off buying life insurance for the longest time because I knew it was going to be time-consuming to fill out paperwork, go through medical underwriting and wait a few weeks for my final rate and coverage to start. Fortunately, now, it’s simple to buy a life insurance policy. With agents like Bennett Financials', who are highly trained in finding the best policy for your health and situation, the process has become much simpler. Through Bennett Financials' process, you can easily apply online and find out instantly if you’re approved for coverage. In most cases, no medical exam will be needed to finalize coverage, just a few health questions. [Keep in mind that issuance of the policy or payment of benefits may depend upon the answers to health questions given in the application and their truthfulness.]

It’s a modern way to buy life insurance that leaves you with no excuses for putting it off.

The peace of mind is worth it

We all want reassurance that we’re doing the right things with our finances and protecting our families. That’s what life insurance can give you. Life insurance can give you peace of mind in knowing that if the worst were to happen, you’ve helped to financially protect the people who are most important to you. In the meantime, you can live life and enjoy your family which is what matters most.

There’s really no reason to go without life insurance if it’s something you need. As you work on your family’s financial plan, remember to pencil in time to consider what kind of life insurance would be best, for you – what you need the policy to cover and how much coverage is enough. This is time well spent, protecting your family’s financial future.

Share

Tweet

Share

Mail

By Anthony H

•

21 Jun, 2023

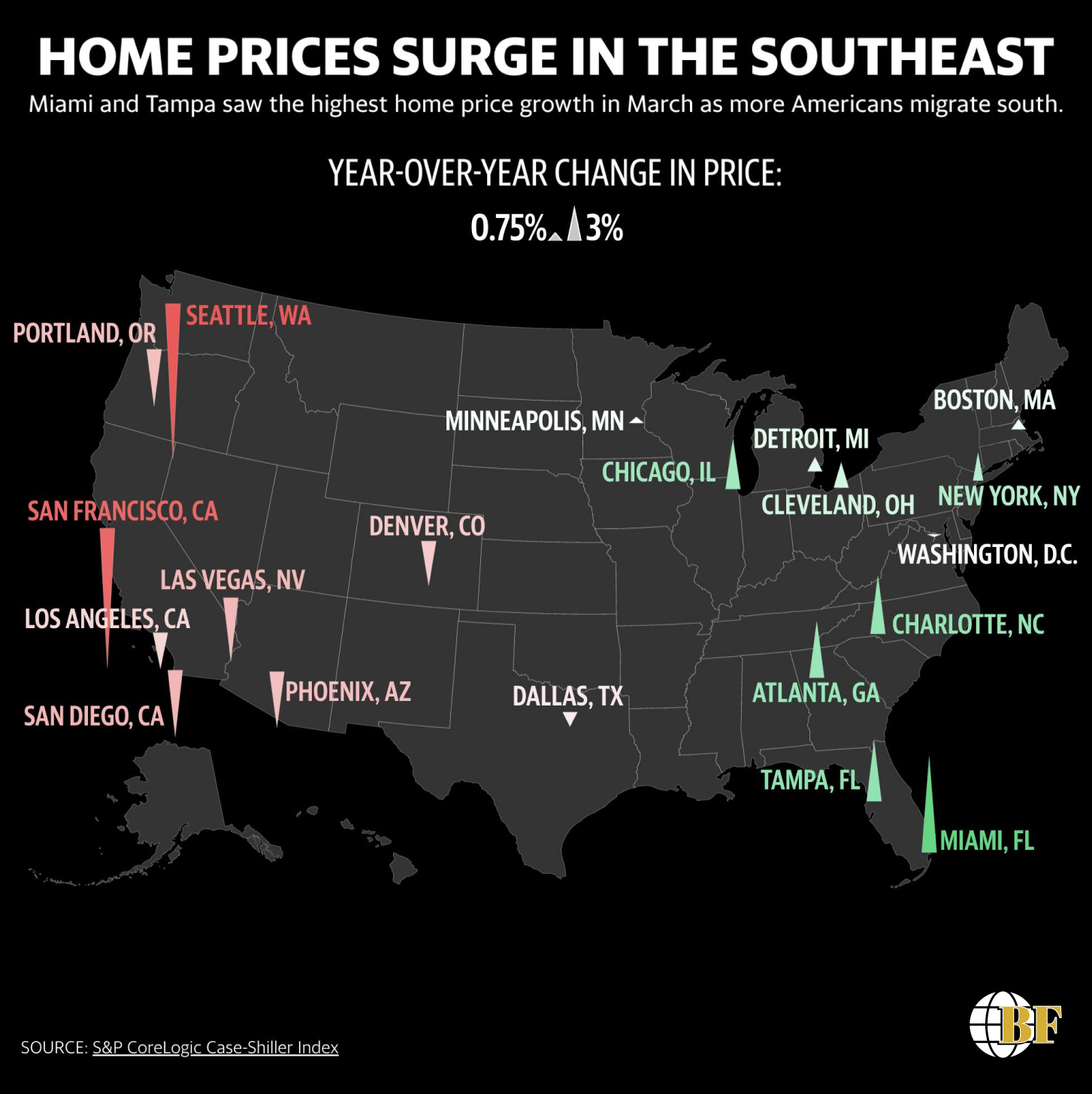

In today's ever-evolving financial landscape, real estate investment has emerged as a powerful wealth-building strategy. Bennett Financial, a forward-thinking leader in the financial industry, recognizes the potential for individuals to achieve substantial returns by strategically navigating thriving real estate markets. As the South East experiences a surge in home prices, particularly in Miami and Tampa, now is the time to explore the exciting opportunities that lie within this sector.

By Gram Henderson

•

16 Jan, 2023

Life insurance can be used as an infinite banking system, which is a way to use cash value life insurance to create a self-funding source of wealth. This is done by taking out a cash value life insurance policy, and then using the cash value of the policy to fund other investments or expenses.

By Sarah Woodbeck

•

09 Jan, 2022

Mortgage protection insurance is a type of life insurance designed to pay off a borrower's mortgage in the event of their death, disability, or job loss. The main benefit of mortgage protection insurance is that it provides financial security for a borrower's family in the event of their death or incapacity, by ensuring that their mortgage is paid off and their home remains in their family. Additionally, some policies may offer additional benefits such as cover for disability, unemployment and critical illness. This means that the policyholder and their family will not have to worry about losing their home and will have peace of mind knowing that their mortgage will be taken care of. It's a great way to ensure that your loved ones will not be left with a mortgage payment they cannot afford.

About Us

We are dedicated to empowering individuals and businesses to achieve their financial goals through expert guidance, tailored strategies, and trusted partnerships. Elevate your financial journey with us.

Contact info

Headquarters: Chattanooga, TN 37405

(423) 598-6657

Help@BennettFinancial.org