Unwrapping Financial Wisdom: Navigating the Holiday Season with Smart Money Moves.

Dec 19, 2023

Explore our latest insights on holiday spending, budgeting hacks, and turning festivities into financial success.

'Tis the season to be jolly,

but that doesn't mean your wallet has to feel the strain. As the holiday tunes start playing and the festive decorations go up, it's time to think strategically about your spending to make sure your joy doesn't come with a hefty price tag.

Embrace the Gift of Budgeting

The first step in achieving holiday spending success is creating a budget. Allocate funds for gifts, decorations, and special events to avoid overspending. Remember, it's not about how much you spend but the thoughtfulness behind your choices.

Craft a Thoughtful Gift List

Avoid the last-minute shopping frenzy by creating a thoughtful gift list. Consider personalized gifts or experiences that carry sentimental value. This not only adds a personal touch but can also be budget-friendly.

Hunt for Holiday Deals

Don't shy away from sales and discounts. Many retailers offer special promotions during the holiday season. Keep an eye out for deals to make the most of your budget. Shopping strategically can stretch your dollars further.

Secret Santa and Group Gifting

If your family or friends usually exchange gifts, consider suggesting a Secret Santa or group gifting arrangement. This way, each person receives a meaningful gift without the pressure of buying for everyone.

DIY Decor and Wrapping

Get creative with holiday decorations and gift wrapping. DIY projects not only add a personal touch but can also be a fun and festive activity for the family. Plus, it's often more cost-effective than buying pre-made decorations.

Focus on Experiences

Consider shifting the focus from material gifts to shared experiences. Plan a family outing, a cozy movie night, or a virtual gathering with loved ones. The memories created will last longer than any physical gift.

Your Golden Guide to Financial Joy ✨

As you embark on this festive financial journey, remember that smart money moves lead to a merrier season. For more insights on holiday spending, budgeting hacks, and turning festivities into financial success, reach out to us. Let's make this season one to remember without the financial stress. Wishing you a joyous and financially savvy holiday season!

Share

Tweet

Share

Mail

By Anthony H

•

21 Jun, 2023

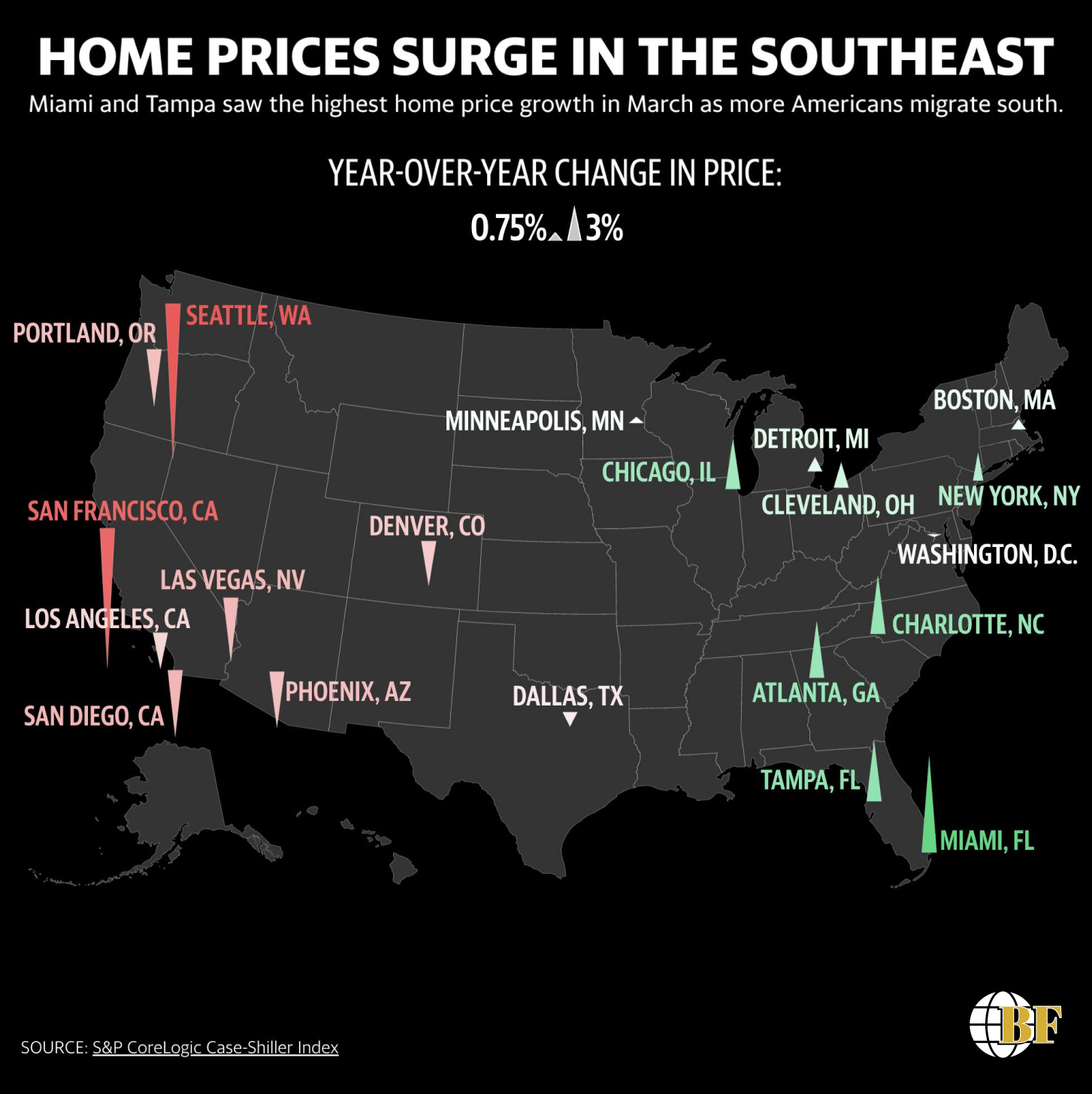

In today's ever-evolving financial landscape, real estate investment has emerged as a powerful wealth-building strategy. Bennett Financial, a forward-thinking leader in the financial industry, recognizes the potential for individuals to achieve substantial returns by strategically navigating thriving real estate markets. As the South East experiences a surge in home prices, particularly in Miami and Tampa, now is the time to explore the exciting opportunities that lie within this sector.

By Gram Henderson

•

16 Jan, 2023

Life insurance can be used as an infinite banking system, which is a way to use cash value life insurance to create a self-funding source of wealth. This is done by taking out a cash value life insurance policy, and then using the cash value of the policy to fund other investments or expenses.

By Sarah Woodbeck

•

09 Jan, 2022

Mortgage protection insurance is a type of life insurance designed to pay off a borrower's mortgage in the event of their death, disability, or job loss. The main benefit of mortgage protection insurance is that it provides financial security for a borrower's family in the event of their death or incapacity, by ensuring that their mortgage is paid off and their home remains in their family. Additionally, some policies may offer additional benefits such as cover for disability, unemployment and critical illness. This means that the policyholder and their family will not have to worry about losing their home and will have peace of mind knowing that their mortgage will be taken care of. It's a great way to ensure that your loved ones will not be left with a mortgage payment they cannot afford.

By Nathan Earwood

•

09 Jan, 2022

Life insurance can provide financial security for your loved ones in the event of your death, provide a source of income for your family, and can be used as a savings and investment tool. It's a responsible way to protect the people you care about most and ensure their financial well-being.

About Us

We are dedicated to empowering individuals and businesses to achieve their financial goals through expert guidance, tailored strategies, and trusted partnerships. Elevate your financial journey with us.

Contact info

Headquarters: Chattanooga, TN 37405

(423) 598-6657

Help@BennettFinancial.org